How to create the expense reports in Oracle Fusion Expenses

Hi friends , in this post , we will discuss how we can create the expense reports in oracle fusion expenses. We will share the detail steps how we can create the expense report and submit the expenses in oracle fusion.

Now we have completed the Expense setups in Oracle Fusion. Now we create the Expense report in Oracle Fusion application and verify the

configurations as process flow too. But before testing the Expense system, there are few prerequisites.

For example , First important Thing , Employee submits the expense report , so first of all Employee should be created in our oracle fusion

application and we are using the employee supervisor approval hierarchy for Expense approval , so the supervisor which we want to attach to

the employee that should also be created in oracle fusion application. If not , then first we will create the supervisor Employee record and then

create the employee record who will submit the expense report.

Test Case

Employee who submit the Expense Report: Ravi Kumar

Employee which is a supervisor of Ravi Kumar and will approve the Expense report is: Ajay Sharma’.

Steps to Create the Expense Report in Oracle Fusion

Here below is the steps to create the expense report in oracle fusion expenses.

Creating Supervisor Employee Record : Ajay Sharma

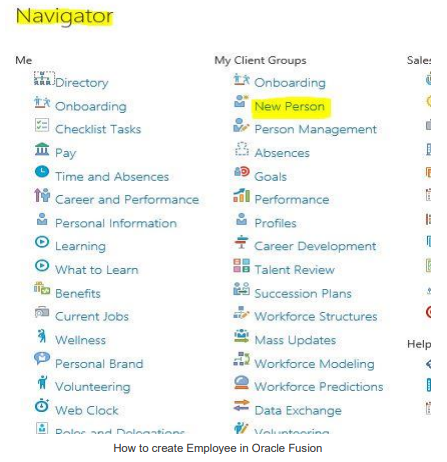

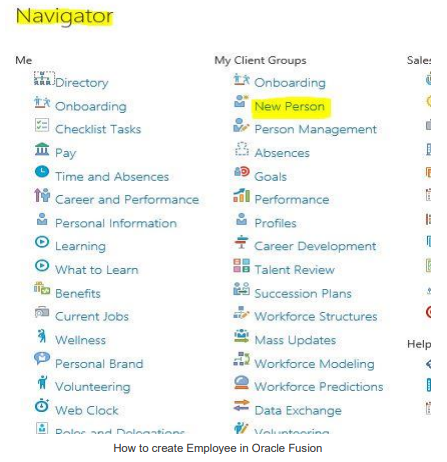

Step1:- Go to My Client Groups ==. New Person

|

| How to create the expense reports in Oracle Fusion Expenses |

Step 2:- Now we need to go to the Hire an employee option to create employee in Oracle Fusion.

Step 3:-

Here below, we need to define the Legal Employer options under which we need to create employee in Oracle Fusion.

Here in this page , We need to define the employee assignment details. We need to define the Employee BU, Job, Position,

Location, Organization and the Supervisor Details also and then Click Next. Enter the Expense Information’s in the next page and click

submit then supervisor employee record will be created.

Creating Employee record who will enter the Expense Report

Step1:- Go to My Client Groups ==. New Person

Step 2:- Now we need to go to the Hire an employee option to create employee in Oracle Fusion.

Step 3:-

Here below, we need to define the Legal Employer options under which we need to create employee in Oracle Fusion.

Step 4:-

Here below we need to define the Employee Address and the Employee email and Phone details. Now click on Next Button.

Step 5:-

Defining Employee email and Phone details. Now click on Next Button.

Step 6:- Here in this page , We need to define the employee assignment details. We need to define the Employee BU, Job, Position,

Location, Organization and the Supervisor Details also.

|

| How to create the expense reports in Oracle Fusion Expenses |